Back in May we told you more online services were coming your way.

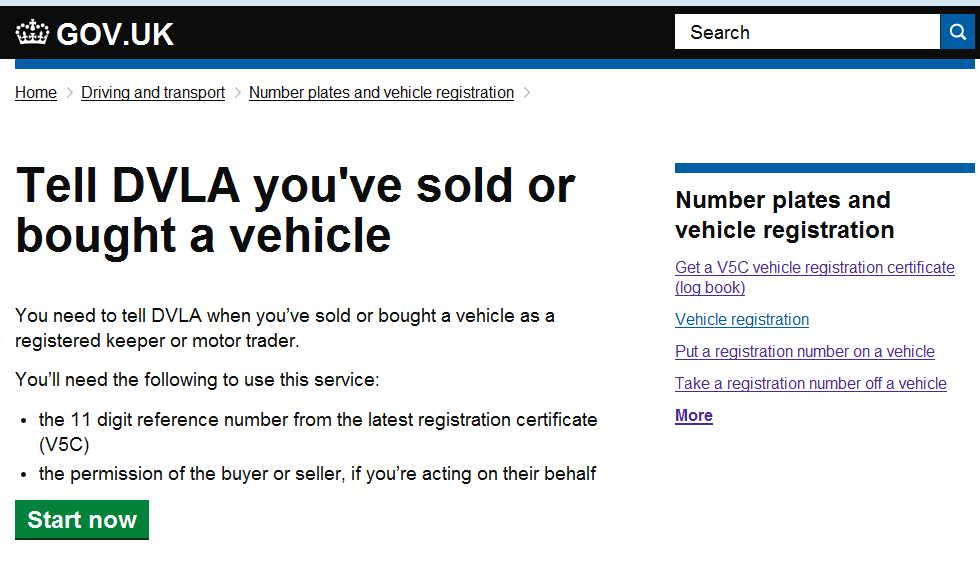

We’re pleased to announce that Tell DVLA you've sold or bought a vehicle has successfully passed the Government Digital Service assessment and is now available in public Beta. As with all new services we’re looking for your feedback which will help us to continuously improve the services for you.

Dealers can now tell DVLA when they sell a vehicle out of trade

- by using the service ‘sold a vehicle out of trade’.

Before using the online service you’ll need the latest registration certificate (V5C).

In addition, we’ve introduced the following online services for use by private individuals:

- sold your vehicle into the motor trade - following customer feedback, we’ve further enhanced this service to allow private individuals to tell us when they sell their vehicle to a motor trader

- sold your vehicle to a private individual or business - private individuals can now tell DVLA when they sell their vehicle to another private individual or business.

All services are available via GOV.UK

We’ll continue to use your feedback to continuously improve these services. This will make sure that they are ‘simple, better and safer’ for you, our customers.

16 comments

Comment by Charlotte posted on

I was just wondering if this method would generate a new V5 with the new keepers details or whether the V5 still needs to be sent to the DVLA.

Thanks in advance

Comment by DVLA digital comms team posted on

Hi Charlotte

This service has been developed to replace the paper application. There's no need to return the original registration certificate V5C. Thanks

Comment by Chris posted on

What happens to unused months of tax when you sell a vehicle?

Comment by DVLA digital comms team posted on

Hi Chris - an automatic refund will be issued for any full months remaining vehicle tax when a notification is received from the person named on DVLA vehicle register that the:

- vehicle has been sold or transferred

- vehicle has been scrapped at an Authorised Treatment Facility

- vehicle has been exported

- vehicle has been removed from the road and the person on the vehicle register has made a Statutory Off Road Notification (SORN)

- tax class of the vehicle has changed to an exempt duty tax class

More information is available at: https://www.gov.uk/government/news/vehicle-tax-changes

Comment by G.Con posted on

WHY can't tax be 6 /12 months from the day you pay NOT the 1st of each month, can't be that hard these days !

I bought a car on the 22nd of Dec and had to pay from the 01st Dec, The previous owner also couldn't claim the tax back for that month, so the DVLA have 2 lots of tax for the same car for the same month....is this fraud/theft ?

Comment by DVLA digital comms team posted on

Vehicle tax is required by law and if legislation were changed in order to allow vehicle tax to commence and end on any day of the month, there would be a considerable increase to the calculations for each rate of duty. This would result in a substantial increase in resources and significant development costs, which would ultimately have to be passed on to the taxpayer. Future decisions will rest on the policy priorities of government.

Any potential revenue gains are likely to be offset by motorists receiving a refund, which they may not have received prior to 1 October.

As you know to get a refund for each full calendar month left on the vehicle tax, you must notify DVLA before the end of the month. With the introduction of this new electronic channel which allows you to notify the sale of your vehicle online....all transactions will update in real-time. When a sale is notified at 23:59 hours on any calendar month, any refund due will be paid for complete calendar months remaining, from the date the transaction was made.

Comment by william posted on

Can I leave a car on a sorn in a public parking bay that is for other road users

Comment by DVLA digital comms team posted on

Hi Williams, you can make a SORN if you don’t use or keep your vehicle on a public road, eg you keep it in a garage, on a drive or on private land. Please contact our vehicle enquries team for more information - http://www.gov.uk/contact-the-dvla

Comment by Jonny Scott posted on

Hi,

What about permanent export?

is this something that will be introduced as well?

Regards

Comment by DVLA digital comms team posted on

Delivery of a permanent export online service will be considered as part of VMPR2. The timeline for this has yet to be confirmed. Once we have more information on future developments we will communicate via our digital blog/Inside DVLA services.

Comment by Len posted on

I purchased a used car from a dealer on the 16th July and was informed by them that they had sent,on my behalf,the log book with my details as the new owner. How long will it be before I receive the new log book as I am still waiting for it.

Comment by Linda G Davies posted on

Hi Len, we aim to send out a new V5C to you within 2 to 4 weeks of getting the old V5C from the seller. Thanks

Comment by John Reekie-Buchan posted on

Can I renew my road tax before I receive a letter from you telling me it is due?

Comment by Linda G Davies posted on

Hi John, you can renew your road tax before it's due, but only from the 5th of the month that it is due to expire in. Thanks

Comment by Susan Westbrook posted on

I can't find my V5C form, how can I get a replacement?

Comment by DVLA digital comms team posted on

Please contact our vehicle enquiries team to get a replacement: http://www.gov.uk/contact-the-dvla